After years of restricting the amounts older Australians could contribute into super the Government really loosened the screws and starting 1 July 2022 provided many more opportunities for older Australians to build up their nest egg.

From 1 July 2022 the Work Test has been removed except for those aged between 67 to under 75 intending to make a personal concessional contribution.

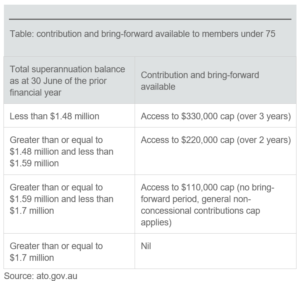

With the removal of the Work Test also comes access for those aged up to 75 to the bring forward rule which means those aged up to 75 may be able to contribute up to 3 years of non-concessional contributions in one year to a total of $330,000.

Here is a detailed summary of current contribution limits:

Concessional Contributions:

Concessional contributions are contributions made into your SMSF that are included in the SMSF’s assessable income and taxed at 15%. Someone else, either the employer or the member personally has claimed a tax deduction for these contributions.

The current concessional contributions cap is $27,500.

You must meet the work test (or work test exemption) if you make a personal concessional contribution and are aged between 67 to under 75*.

It is important to note if turning 67 during the financial year that the work test does not apply to the period before you turn 67.

Under the new rules, the work test can be met in any period in the financial year of the contribution, although care should be taken in case circumstances change and the work test cannot be met but a contribution has already been made.

Unused concessional cap carry forward:

From 1 July 2018, members can make ‘carry-forward’ concessional super contributions if they have a total superannuation balance of less than $500,000. Members can access any unused concessional amounts on a rolling basis for 5 years. Amounts carried forward that have not been used after 5 years will expire.

Non-concessional contributions:

The current non-concessional cap is $110,000.

From 1 July 2022 members under 75* may be able to make non-concessional contributions of $330,000 using the 3 year bring forward rule (by using up 3 years of contributions).

Bring Forward arrangements

*Contributions can be made until the 28th day of the month following a person’s 75th birthday

**From age 75 the only type of contributions that can be made are downsizer contributions or compulsory SGC employer contributions.

As you can see the removal of the work test as well as being able to utilise the 3 year bring forward amounts of up to $330,000 creates many more opportunities for senior Australians in the 67 to under 75 age bracket to contribute to super.

This may be the age where seniors have some extra money they wish to contribute or they have an inheritance. It is also a great opportunity for some strategic planning to utilise a re-contribution strategy to change the taxable components of their superannuation benefits from taxable to tax-free so that they can leave their adult children tax free superannuation benefits. You will need to talk to an SMSF expert to assist you with this. We work with our clients to achieve these estate planning outcomes.

These benefits combined with the new lower age for the downsizer provisions means senior Australians are in a better position than ever to build up their nest egg.

You can read more about how you can sell your home and contribute the proceeds into super using the downsizer provisions here:

Want to know more about SMSFs? You can purchase Susan’s eBook “SMSF Success – From Set Up to Thriving” available on our website now.