Before considering the amounts that can be contributed into super it is worth mentioning that the amounts that employers are required to contribute (compulsory SGC amounts) will be increasing from 11% to 11.5% from 1st July 2024.

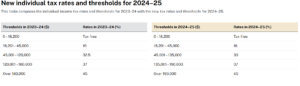

Also, tax cuts are due to start on 1st July 2024. This will result in most people paying less tax next financial year so any tax deductions that can be brought forward to this year are beneficial from a taxation point of view.

The tax cuts are in the table below:

The following contributions can be made to top up your super before 30th June 2024:

Tax Deductible (Concessional Contributions)

If you are considering making deductible contributions for 2023-24 allow enough time for the contributions to be cleared by your bank. Any contributions should be completed by Thursday 27th June 2024.

Also note if employer contributions are being paid through a superannuation clearing house you should have these paid by mid-June in order to have these allocated to employee’s accounts by the end of the financial year.

Anyone* can now claim a tax deduction up to $27,500. Don’t forget this includes any employer contributions or salary sacrifice that have been made on your behalf so deduct them before making your contribution. *You must meet the “work test” if aged over 67, after age 75 only SGC contributions can be accepted.

You must have a signed “Notice of Intent to claim a tax deduction” and get an acknowledgement from the fund prior to lodging your personal tax return in order to qualify for a tax deduction.

The Concessional Contributions limit will be increasing to $30,000 from 1 July 2024.

Carry Forward Concessional Contributions

If you have a total super balance (TSB) of less than $500,000 on 30 June of the previous financial year, you may be entitled to make use of unused concessional cap amounts from previous years. Unused cap amounts are available for 5 years and expire after this. For example, a 2018-19 unused cap amount that is not used by the end of 2023-24 will expire. Unused concessional cap amounts are applied automatically once you exceed the cap in any year.

Your available carry-forward contribution amounts are shown on ATO online services (select Super, then Information, then Carry forward concessional contributions) see below:

Log into ATO online services and select the Super Tab.

Select drop down box > Information

Select drop down box > Carry-forward concessional Contributions

“Double Deduction” Strategy using “contributions reserving” in an SMSF

If you have made a large capital gain, have large taxable income one year or a bumper year in your business an extra tax deduction may be useful to minimise tax.

What is “contributions reserving”?

According to Superannuation Legislation, when an SMSF receives a contribution, the Trustees have 28 days after the end of the month in which that contribution is received to allocate that contribution to a member’s account. This provides an opportunity in an SMSF when a contribution is received in June at the end of a financial year and is not required to be allocated to a member until July of the following financial year.

In simple terms, the member can claim a tax deduction for up to two years deductions, i.e. this financial year and next financial year which is contributed in June but not allocated until July of the next financial year. The fund pays tax on the full amount (15%). Only the amount allocated to this year counts towards this year’s caps and therefore even though contributing and claiming a “double deduction” the member does not exceed the concessional contribution caps. For example, a member can make contributions during 2023-24 of $27,500 and a further contribution of $30,000 in June 2024 without exceeding the contribution caps. (Concessional contributions include all deductible contributions including employer contributions).

Further information is available in my blog post https://susanoconnoraccounting.com.au/plan-now-maximise-deductions-before-tax-cuts/

Expert advice should be sought from a Licensed Adviser as there are risks involved with this strategy for example if the rules are not strictly followed, or contributions amounts are exceeded the following financial year, the ATO may consider that the concessional caps have been exceeded and issue an Excess Concessional Contributions Determination.

If utilised correctly this is a very useful strategy to minimise tax in one year and can also be used in combination with the unused carry forward amounts if eligible.

Non-Concessional Contributions

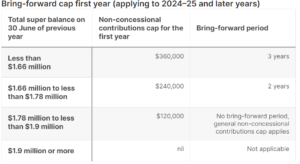

The current non-concessional cap is $110,000. This is increasing to $120,000 on 1 July 2024.

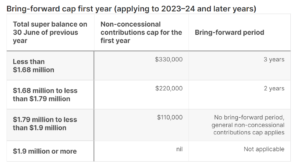

Members under 75* may be able to make non-concessional contributions of $330,000 using the ‘3 year bring forward rule’ (by using up 3 years of contributions) – see the table below.

However, with the cap increasing to $120,000 on 1 July 2024 a better strategy would be to contribute $110,000 in June 2024 and then contribute $360,000 in July 2024 when the caps increase to $120,000 per year and the 3 year bring forward amount is $360,000.

Bring Forward arrangements

*Contributions can be made until the 28th day of the month following a person’s 75th birthday

**From age 75 the only type of contributions that can be made are downsizer contributions or compulsory SGC employer contributions.

Other Contributions to consider if you are aged over 75:

Downsizer Contribution

If you are 55 years or older and meet the eligibility requirements, you may be able to choose to make a downsizer contribution into your superannuation of up to $300,000 from the proceeds of selling your home. Your downsizer contribution is not a non-concessional contribution and will not count towards your contributions caps.

There is strict eligibility criteria and procedures to be followed, so expert advice is needed before proceeding. Please contact us before proceeding.

If you are aged over 75 apart from employer (SGC) contributions, downsizer contributions are the only contributions that can be made.

For more information I have written a detailed blog here https://susanoconnoraccounting.com.au/downsizer-contributions-are-you-eligible/

Other contributions to consider if you are on a low income:

Spouse Superannuation Tax Offset

An individual may claim the maximum tax offset of $540 for superannuation contributions they make to an eligible superannuation fund of their spouse if the sum of their spouse’s assessable income, total reportable fringe benefit amounts, and reportable employer superannuation contributions is $37,000 or less (phased out up to $40,000). In order to maximise the rebate, you would need to contribute a non-concessional amount of $3,000 to get the tax offset which equates to $540 on a spouse income of $37,000 or less. A number of conditions need to be satisfied by the spouse, please speak to me for more information before proceeding.

Government Superannuation Co-Contribution

The maximum co-contribution is $500 for a non-concessional contribution of $1,000. Income must be below $43,445, which is phased out to a maximum of $58,445. Other eligibility criteria also applies, please check with me before proceeding.

Low Income Superannuation Contribution (LISC)

Individuals with an adjusted income of $37,000 or less will be entitled to LISC which basically represents a refund of the concessional contributions tax paid at 15% up to $500. You do not have to do anything – the ATO will work this out when you lodge your tax return.

Contributions Splitting With Spouse

If a client has a much larger super balance than their spouse, they could consider splitting their contributions in order to boost their spouse’s balance. You can split up to 85% of your concessional contributions to your spouse. However, some restrictions do apply and this needs to be considered as part of your overall long term superannuation strategy.

As you can see there are technicalities involved, and it is always best to speak to a SMSF expert, like ourselves, who can provide advice. This is general advice only and I have not considered your personal objectives or circumstances, please speak to a Licensed Adviser before proceeding.

Information current as at 14 June 2024.